KULICKE & SOFFA INDUSTRIES (KLIC)·Q1 2026 Earnings Summary

Kulicke & Soffa Beats Q1: Revenue +5%, EPS +33% vs. Estimates, Stock Jumps 7%

February 5, 2026 · by Fintool AI Agent

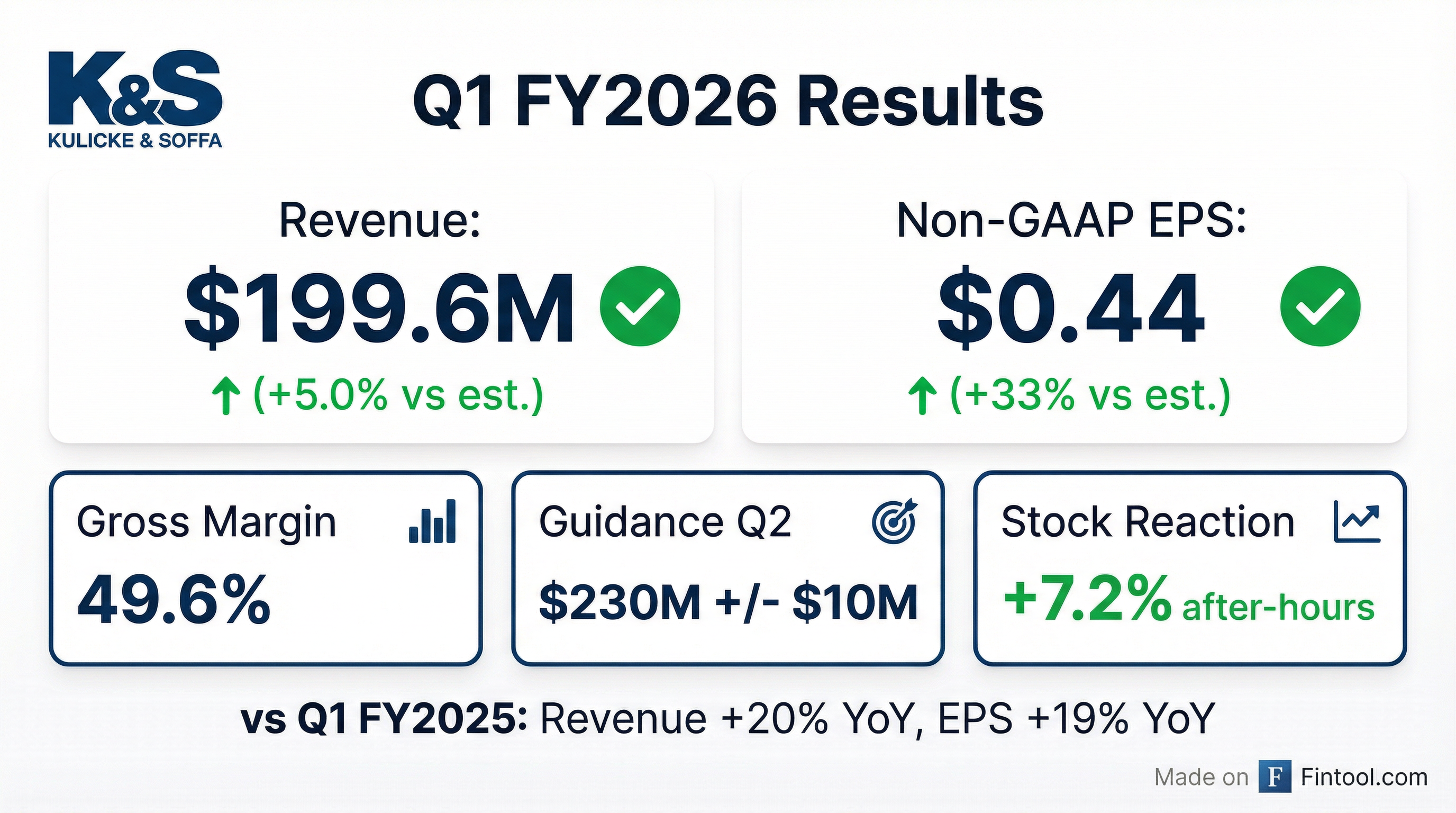

Kulicke & Soffa (NASDAQ: KLIC) delivered a strong double beat in Q1 FY2026, with revenue of $199.6M exceeding Street estimates by 5% and non-GAAP EPS of $0.44 crushing consensus by 33%. The semiconductor assembly equipment maker saw shares surge 7.2% after hours as investors responded to both the beat and robust Q2 guidance of $230M in revenue.

Did Kulicke & Soffa Beat Earnings?

Yes — decisively. K&S delivered beats on both top and bottom lines, marking a sharp inflection from the challenging quarters earlier in the fiscal year.

The 49.6% gross margin represented a 350bp improvement from Q4 FY2025's 46.0%, signaling improved product mix and operational leverage.

Year-over-Year Comparison

Revenue growth accelerated to 20% YoY, the strongest year-over-year performance since the semiconductor cycle began recovering.

What Did Management Guide?

Q2 FY2026 guidance came in strong, above current Street expectations and signaling continued momentum in the semiconductor assembly market.

This implies sequential growth of 15% on revenue and 52% on non-GAAP EPS — a significant acceleration that reflects improving end-market conditions.

Full-Year FY2026 Outlook

On the earnings call, Interim CEO Lester Wong provided visibility into the rest of fiscal 2026:

"We think Q3 definitely will be sequentially better than Q2. I think the second half of FY 2026 should be about 15%-20% better than the first half."

When asked if this was conservative, Wong noted: "There is still a lot of uncertainty in terms of some of the macros... But at this point, from all my discussion with customers, it's getting much more solid. There could be potential upside on top of that."

Guidance vs. Forward Estimates

*Forward estimates as of pre-report

The guidance implies K&S expects demand to remain robust, with management citing preparations for "customers' higher near-term capacity requirements."

How Did the Stock React?

KLIC surged 7.2% after hours following the earnings release, reflecting the magnitude of the beat and strong forward guidance.

The stock is trading near its 52-week high, up 109% from its 52-week low of $26.63.

Segment Performance

End Market Breakdown

Utilization Rates by Region

Utilization rates signal a healthy capacity environment:

For memory specifically, ball bonding utilization exceeds 85% (up from mid-70% range last year), indicating healthy NAND assembly demand.

What Changed From Last Quarter?

Q1 FY2026 marked a notable inflection point for Kulicke & Soffa after several challenging quarters:

Revenue Trajectory

Key changes from Q4 FY2025:

The 600bps improvement in non-GAAP operating margin demonstrates significant operating leverage as revenue scales.

What Did Management Say?

Interim CEO and CFO Lester Wong highlighted the company's strategic positioning and the market environment:

"Data center is basically the central driver for this cycle. We support data center in many ways. We have a very strong AP portfolio. It's the best-in-class for chiplet and heterogeneous logic applications."

"This is an interesting time at the company. We're either a dominant incumbent leader or are aggressively taking share in all key markets we serve."

Key strategic themes:

- Data center as central driver — Supporting data centers through advanced packaging, memory, and general semiconductor solutions

- Capacity expansion — Expanding Singapore facility to increase fluxless TCB production capacity by 3x

- Long-term positioning — Investments in Power Semiconductor, Advanced Dispense, Vertical Wire, and Fluxless Thermo-Compression

Q&A Highlights: Advanced Packaging & Memory Opportunities

The earnings call Q&A revealed significant details on K&S's growth initiatives:

Thermo-Compression Bonding (TCB) — Over $100M This Year

"For TCB, it'll be over $100 million [this fiscal year]."

- 120 TCB systems in the field, half are fluxless

- Started with IDM in the US, expanded to foundry, now seeing strong OSAT demand

- Plasma fluxless solution in qualification at major foundry customer; formic acid already in high-volume production

HBM (High Bandwidth Memory) — First System Shipped

- Shipped first HBM system to a large memory customer in December quarter

- System undergoing qualification at customer's US facility

- Volume production expected FY2027; potential POs within FY2026

- Fluxless thermo-compression remains a strong alternative to hybrid bonding for next-gen HBM

High Bandwidth Flash (HBF) — CY2027 Opportunity

"HBF targets to match HBM bandwidth to 8-16 times the capacity... This will probably be more of a CY 2027 play."

- Designed to merge NAND-level capacity with HBM-class performance for AI workloads

- TCB technology (Aptura) will be used; currently exploring with several customers

- Next milestone: shipping qualification system

Vertical Wire — 8 Customer Engagements

- Working with 8 customers in Korea, China, and the US

- Provides cost-effective bandwidth through die stacking for DRAM

- Initial adoption possible in H2 FY2026, meaningful expansion in FY2027

- Positive customer feedback; K&S pioneered the technology

Capital Allocation

K&S continued its shareholder return program despite near-term cash flow headwinds:

The negative operating cash flow was driven by working capital build (accounts receivable up $32M, inventory up $16M) as the company prepares for higher demand.

Balance Sheet Snapshot

K&S maintains a debt-free balance sheet with $481M in cash and investments, providing significant flexibility for capital allocation and potential M&A.

Key Risks to Monitor

- Semiconductor cycle volatility — The industry remains cyclical, and demand visibility is limited

- Customer concentration — Major customers in automotive and memory segments

- Leadership transition — Lester Wong serving as Interim CEO while search continues

- Geopolitical exposure — Significant operations in Singapore and exposure to China markets

- Electronics Assembly cessation — Company is exiting this business segment

Gross Margin Outlook

Management expects gross margins to remain at 49-50% for the rest of FY2026, driven by:

- Higher-margin product mix — Strong demand for high-performance ball bonders (better margins than LED products)

- Volume leverage — Increased production helps absorption

- Cost discipline — Continued focus on operational efficiency even during the ramp

Forward Catalysts

- Q2 FY2026 earnings (May 2026) — Execution against $230M revenue guide

- H2 FY2026 acceleration — Management expects 15-20% growth vs H1

- HBM qualification — Next milestone is additional system shipment to memory customer

- TCB revenue scaling — Tracking to >$100M for FY2026

- Vertical Wire traction — 8 customers engaged, initial adoption possible H2 FY2026

- High Bandwidth Flash — CY2027 commercialization opportunity

- Permanent CEO appointment — Leadership transition resolution

The Bottom Line

Kulicke & Soffa delivered an impressive Q1 FY2026, beating estimates on both revenue (+5%) and EPS (+33%) while guiding Q2 significantly above Street expectations. The earnings call revealed a company positioned at an inflection point — management expects H2 FY2026 to be 15-20% better than H1, with data center as the central driver of this cycle.

Key takeaways for investors:

- TCB business scaling — On track for >$100M in FY2026, with 120 systems deployed and Singapore capacity expanding 3x

- Memory expansion — First HBM system shipped; volume production expected FY2027

- Utilization signals demand — China at 90%+, memory at 85%+, general semi at 80%+ indicate healthy capacity environment

- Gross margins holding — 49-50% expected through FY2026 on better product mix and volume leverage

With a debt-free balance sheet, $481M in cash, and multiple growth levers in advanced packaging, the stock's 7% after-hours move reflects renewed confidence in K&S's positioning for the semiconductor recovery and AI-driven demand.

Data sources: Company filings, S&P Global